Introduction

In this article, we will delve into the world of certified public accountants (CPA) in Shrewsbury. Whether you are a novice or a seasoned professional, understanding the proper steps and timelines for CPA training is essential. We will guide you through the process, highlighting key points and providing expert insights.

Step 1: Timing and Planning

Timing is crucial when it comes to CPA training. It is recommended to start the process in the fall and winter months. This timeframe allows ample time to develop your CPA plan, hold public hearings, and prepare application materials. Additionally, you will need to submit an FY 23 CPA budget to the Springtown meeting. This comprehensive preparation phase is essential before moving forward.

Step 2: Town Meeting

Once you have completed the initial planning and budgeting stage, it’s time to present your finalized budget to the town meeting. In Shrewsbury, town meetings typically take place in May or June. This meeting will provide an opportunity to gain approval for your budget and move forward with the next steps.

Step 3: Project Applications and Evaluation

After obtaining approval for your budget, you can begin accepting project applications. Most communities in Shrewsbury start their application period in early September, as it allows for increased community engagement. As the CPA committee, you will need to meet with the applicants, conduct due diligence, and make recommendations for project funding. This process usually takes place during the fall and winter months.

Step 4: Voting on Projects

Once the evaluation process is complete, it’s time to vote on the selected projects. This final step typically occurs at the Spring 2023 town meeting. By this time, you will have an approved budget and sufficient funds to allocate to the chosen projects. Voting and allocating funds for these projects are crucial to the CPA process.

Additional Considerations

-

Special Time Meetings: In some instances, communities may opt for a special time meeting in addition to the annual town meeting. This allows for a faster approval process and more flexibility in scheduling project proposals.

-

Fall Town Meeting: Certain communities, such as Rockport and Cambridge, regularly hold fall town meetings. This can be a viable option for undertaking CPA projects. However, it’s important to note that unless your town has a guaranteed fall town meeting, it may not be practical to call a meeting solely for CPA projects.

-

Pipeline Projects: To maintain a continuous flow of projects, it is recommended to create a pipeline plan. This plan outlines the projects that were not selected in the current round but may be considered in future funding rounds. This approach ensures that valuable projects don’t fall through the cracks.

The Money Piece: Understanding CPA Revenue Sources

To truly grasp the scope of CPA training in Shrewsbury, it’s essential to comprehend the revenue sources. In Shrewsbury, there are two main sources of revenue for CPA projects.

-

Local Surcharge Revenue: The first revenue source is the local surcharge, which is a one percent property tax surcharge approved by the voters. This surcharge brings in approximately $600,000 in revenue. Additionally, there is an estimated $150,000 in local receipts from the state.

-

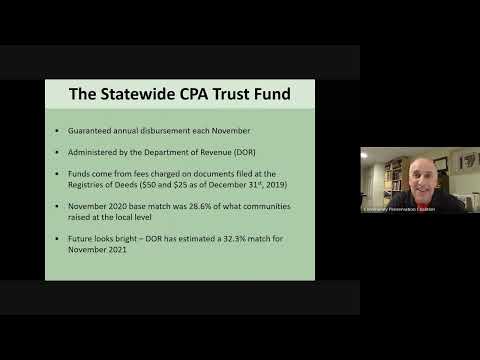

CPA Trust Fund: The second significant revenue source is the annual distribution from the CPA trust fund, which is received every November. The trust fund is a true trust fund that collects money from filings at the Registries of Deeds. The Department of Revenue manages this trust fund and disburses the funds to CPA communities every November 15th.

-

Accrued Interest: The town is also required to track the interest earned by the CPA revenue. At the end of the fiscal year, the accrued interest from the money in the CPA account is credited to the fund. This interest provides an additional source of revenue to support CPA projects.

Conclusion

Becoming a certified public accountant in Shrewsbury requires careful planning, diligent evaluation, and a comprehensive understanding of revenue sources. By following the recommended timeline and steps outlined in this article, you can navigate the CPA training process with confidence. Remember to stay informed about the latest regulations and guidelines to make the most of your CPA experience in Shrewsbury. Don’t wait any longer – start making a difference in your community through CPA projects today!

Note: This article has been optimized for search engines with the use of the keyword “Shrewsbury tax collector” to increase its search visibility and appeal to the target audience.